50-Year vs 30-Year vs 15 Year Mortgages: Choosing what’s right for you

Homeownership has long been viewed as a crucial piece of wealth-building, but as housing costs continue to outpace income growth, many prospective buyers are exploring whether homeownership is for them!

And we’re seeing the government and businesses recognize there is an affordability issue. So are 50-year mortgages the answer? They offer lower monthly payments but come with significant long-term costs.

Let's break down how 50-year mortgages compare to traditional 30-year and 15-year options, and explore whether this extended financing really makes sense for your financial future.

The TL;DR

Here's what you need to know: The more you can pay each month, the less you will pay over your loan term. With a 50-year mortgage, you'll pay substantially more in interest (money that goes straight to the bank) than principal (money that builds equity in your home).

The Affordability Crisis in Housing

It's no secret that homeownership feels increasingly out of reach for many people. Home values have grown at a rate that far exceeds wage increases, leaving many wondering if buying a home is even realistic anymore.

For generations, owning a home has been considered essential to building wealth. However, in today's market, homeownership may not make sense for everyone. For some buyers, renting and investing the monthly savings between a mortgage payment and rent could be a smarter financial move.

Like many investments, real estate benefits from a buy-and-hold long-term strategy. According to ResiClub, more than 40% of homeowners don't have mortgages, and 54% of those are age 65 and older.

That's the buy-and-hold strategy in action—and it may also represent the generation telling you that you "have" to buy a home because it worked for them. But times have changed, and what worked decades ago may not be an option today.

Let's Look at the Numbers

Please note: These examples are for illustrative purposes only and do not constitute financial advice.

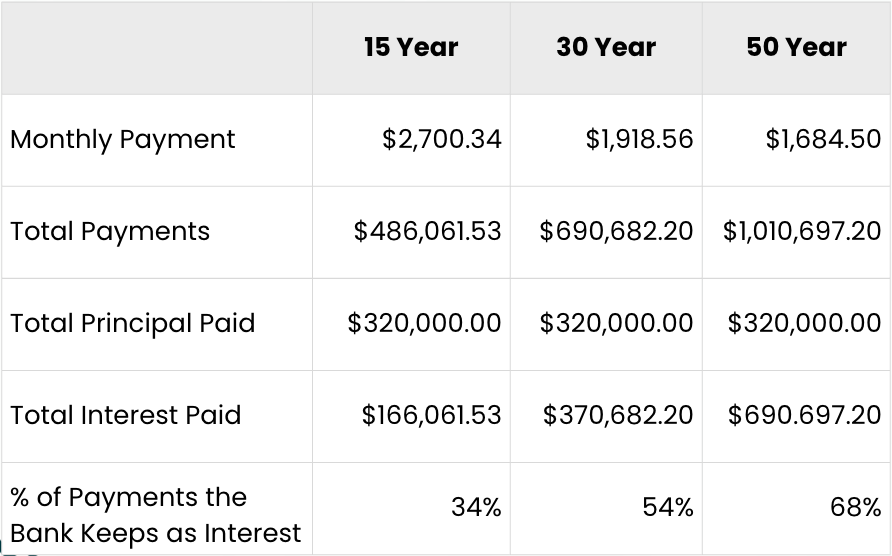

Let's compare three mortgage options for a $400,000 home with 20% down and a fixed interest rate of 6% (even though longer terms carry a longer interest rate). These examples don't include taxes, insurance, HOA fees, or other costs.

The difference is staggering. With a 50-year mortgage, 68% of your payments go to interest, compared to 34% with a 15-year mortgage.

Who Benefits from 50-Year Mortgages?

Banks

They're the clear winners. Banks love the interest they'll collect over five decades. Plus, your home serves as a secured asset—if you default, they'll foreclose, sell the property, take their fees, and you may receive any remaining equity (if there is any).

Current Investors and Homeowners

Since most financial decisions are based on monthly payments rather than total cost, lower monthly payments could drive home prices even higher. This benefits people who already own homes, as their property values may continue to increase.

Some Investors

Some real estate investors might see 50-year mortgages as a way to reduce monthly expenses and free up capital to purchase more properties faster. However, until they eliminate these mortgages and stop paying interest, they'll have lower monthly cash flow and be building equity much more slowly.

A Few Ways to Dig Deeper

Understanding Amortization: Banks Front-Load the Interest

If you're considering any mortgage, pull up a mortgage calculator and examine the amortization table. You'll discover something eye-opening: banks front-load interest payments.

On a 30-year fixed loan at 6%, your monthly payment will go mostly toward interest (not principal) until month 231—that's year 19, month 3. For nearly two decades, you're primarily paying the bank, not building equity in your home.

A Strategy That Could Save You Years and Thousands

Here's a powerful strategy if you're paid biweekly (every two weeks instead of twice a month): You'll receive two "extra" paychecks each year. If you apply those extra payments—let's say $3,000 each—directly to your principal, you could save big.

Using our same example ($400,000 home, 30-year fixed mortgage at 6%), making these extra principal payments could save you 10 years and 1 month off your loan term and over $176,000 in interest payments.

That's right: making additional principal payments might improve your home equity faster than that kitchen remodel you've been dreaming of.

There's No One-Size-Fits-All Answer

You'll find countless perspectives on mortgages and homeownership. The key is to ask questions, initiate Healthy Wealthy Talks as you make financial decisions, and recognize that there isn't one right path for everyone.

Whether you choose a 15-year, 30-year, or 50-year mortgage—or decide that renting makes more sense for your situation—make sure you understand the full picture, not just the monthly payment.

Want a place to talk money? Join The Pledgettes community and connect with others navigating their financial journeys!