“You can’t save your way to retirement”

Have you heard that before but aren’t quite sure what it means? “You can’t save your way to retirement.”

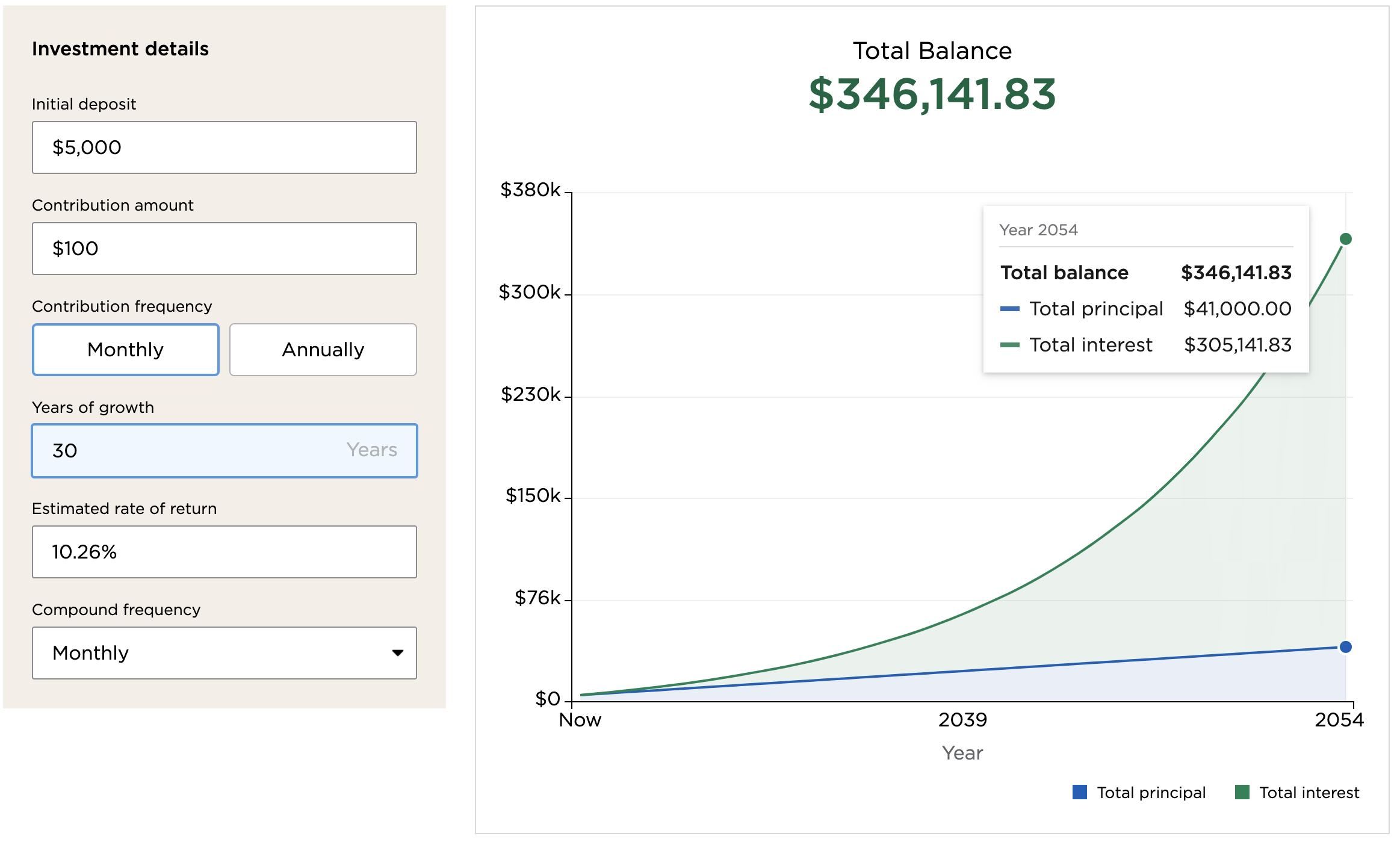

I think this best explained with a compound interest calculator. I like the one on NerdWallet. You can use this to put in different scenarios that work for you.

Another popular saying is, “we want your money to work as hard as you do.” The idea that where you put your money determines if it’s returning 0% (cash) for you or some investments that have more risk but can return higher returns - even doubling your money over time.

Let’s say you have $5000 today and can contribute $100 per month.

Let’s run three scenarios on the Compound Interest Calculator and see how they work.

DISCLAIMER: Returns are not guaranteed. My crystal ball is broken and nobody can predict the future. However these scenar

Scenario 1: Saving Your Way to Retirement

Let’s say you have $5000 today and are saving $100 each month in a saving accounts at global bank earning 0.01% annually. In 30 years you’ll have, $41,068.92. You’ll have contributed $41,000 and have earned $68.92.

That doesn’t feel like your money is working hard. And with inflation, your money will be worth less (you’ll have a lower purchasing power) in 30 years in a global bank savings account than it is today.

Scenario 2: Savings in a HYSA

Let’s do the same scenario but keep the money in a High Yield Savings Account (HYSA) or Money Market account earning 4% annually, this is a reasonable rate as of November 2024.

If the interest rates stay about the same, in 30 years you’ll have $84,744.04. You’ll have contributed $41,000 and have earned $43,744.04.

It’s important to note that your HSYA interest rate will change, with one factor being the Federal Interest Rate.

Scenario 3: Invest in the Stock Market

Same scenario but the S&P 500 receives an average annualized rate of return at 7% - 10% annually. Investopedia shared that since 1957, the annual rate of return for the S&P 500 is 10.26%.

For this example, I’ll do 10.26% in this scenario to use the Investopedia number for illustrative purposes only - future returns are not guaranteed. In 30 years, you’ll have $346,141.83. You’ll have contributed $41,000 and have earned $305,141.83.

As you can see from the chart, the majority of returns happen at the end. Showing that “time in the market beats timing the market.” Time in the market is how long your money is invested in the stock market (30 years is great). “Timing the market” describes people who daytrade or are frequently buying/selling stock positions. If you are trying to time the market, you want to buy low and sell high. That means you need to be right twice: when you buy and when you sell.

There are other ways you can invest your money to have it work hard for you including:

Real Estate

Owning/Operating A Business

Collectibles/Art

Bonds

Gold/Precious Metals

Certificates of Deposits (CDs)

Private Lending

and so much more.

There are Benefits to Savings

While it is important to make sure your money is working as hard as you. It’s not recommended to put all your money into investments.

Having liquid cash (liquid meaning easy to access, like in a High Yield Savings Account) has it’s benefits. If you come into hardship and need some cash to cover your monthly expenses, having some cash can prevent you from going into consumer/credit card debt where you would be paying up to 30% interest if you need to carry a balance (and not pay off your card in full).

Also, life is meant to be lived. “The one that dies with the most money doesn’t really win.” Throughout your life, you’ll want to balance spending money on the Present-Day You and making life for the Future You have more choices (more money = more choices).

Traditional recommendations are having 3-6 months saved in an Emergency Fund. I don’t care for the name “Emergency Fund” because it feels like I’m telling the universe to send me an emergency because I’m prepared for it! Names that Pledgettes have come up with include:

Freedom Fund

Abundance Fund

Financial Confidence Fund

I Got This Fund

Find a name that works for you and make some money moves.

How are you doing? Does this get you more excited about making your money work for you? Or are you feeling more confused or overwhelmed?

Let’s talk about it. The Pledgettes is a financial community for women to talk about money. Jump into our community or schedule some time to talk to me below to find the right path for you!